Is the overseas economy about to have a 'hard landing'?

This week (July 29 ~ August 2), the A-share market as a whole is still in the low consolidation, the SSE index rose 0.5% in five trading days during the week, closing at 2905 points on August 2; Vanguard All-A index rose 0.78% this week. It is worth mentioning that on Wednesday (July 31), northward funds set a new record for the largest single-day inflow since April this year, and the SSE index rose more than 2% on that day. Plates, Shenwan 31 primary industries in 23 of the week rose, including comprehensive, social services, construction and decoration, pharmaceutical and biological, agriculture, forestry and fisheries and other plates rose ahead of the electric power equipment, coal, food and beverage, public utilities, construction materials, automotive and other plates in the week rose and fell behind. From the style point of view, this week is the small and medium-sized micro-cap relative dominance, science and innovation differentiation. Among the style indices and broad-based indices, micro-cap indices such as CSI 2000, CSI 2000, Vantage Microcap and CSI 1000 were the top gainers this week. While Sci-Tech 100, Vantage Bi-Cap, Sci-Tech 50 and others rose at the top, GEM Index, SZSE 100, SZSE 50 and other indices fell at the bottom. In Hong Kong, the Hang Seng Index lost 0.45% during the week; the Hang Seng Technology Index lost 1.69% during the week. In terms of sectors, 6 out of 12 Hang Seng sectoral indices rose this week; among them, energy, telecom, raw materials and other sectors rose in this week, while consumer, real estate and construction, industrial, general and other sectors fell in this week. Most of the world's major asset classes closed lower this week, the three major U.S. stock indices fell deeper this week; oil, the dollar index fell, gold rose. Figure: global major major asset classes in this week's performance Source: Everbright Securities, 36 Krypton

Overseas stock markets closed lower: from interest rate cut trading to recession trading Compared to the flatness of A-shares, investors are still more discussing some key events overseas. the July Fed's interest rate meeting was uneventful, with the interest rate resolution continuing to keep the current benchmark interest rate unchanged. The meeting statement in the expression of some minor changes, such as in the revision of the basis for monetary policy, once again proposed a focus on employment and inflation of the dual-target, the previous statement has been highly concerned about the risk of inflation; employment, there is a “high unemployment rate” new reference, in the framework of the Federal Reserve's dual-targeting system of monetary policy, the unemployment rate Higher on the opening of the rate cut to create very favorable conditions. From this, the conference statement on the tone compared to the previous to be a little more dovish. In the press conference, Powell admitted that the fastest in September will open the rate cut, but also according to the economic needs to keep interest rates unchanged, and adhere to the 2% inflation target. From the revised wording of the meeting statement to the information revealed in Powell's press conference suggests that it is now very close to a rate cut, but at the same time it can also be seen that the Fed's revision of monetary policy is still not detached from the reliance on macro data. In our previous strategy article, “Overseas interest rate cuts open early, how will it affect A shares? In our previous strategy article, “how will overseas rate cuts start early affect A shares?”, the structural dismantling of U.S. inflation downside can be seen, the current U.S. inflation compared to the high point of a substantial decline, but the core inflation is still stubborn; in the structure of the decline in inflation is mainly by the price of consumer durables so driven by the sharp downward movement of the prices of durable goods, while the price of services but the relative firmness. It is because of the asymmetry of U.S. inflation downward, in accordance with the Fed's reliance on the characteristics of macro data, then for September can be opened as the market would like to cut interest rates, there is still a certain degree of uncertainty. Nevertheless, the market is still optimistic about the rate cut in September, whether it is good expectations, or driven by the money-making effect, overseas interest rate cuts trading in full swing this year, the Nasdaq from the beginning of this year to the first half of July has been rising, the first three trading days of this week is also rising. However, by Thursday

Image Source: Sourced from the Internet

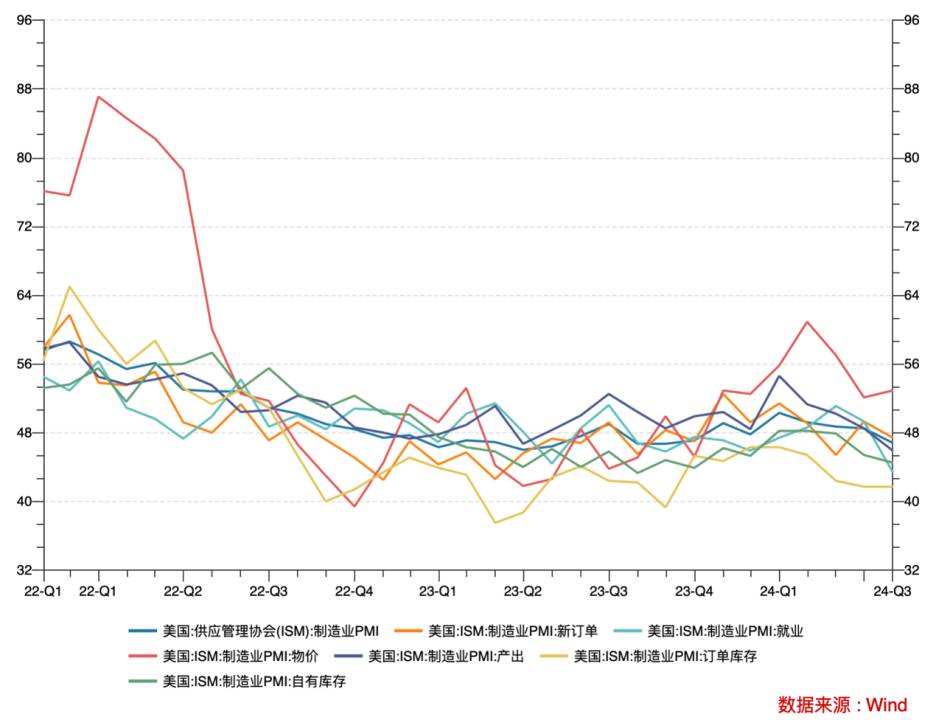

(August 1), U.S. stocks suddenly twisted downward and plunged for two consecutive trading days, and risk aversion triggered a surge in gold prices in the short term. Figure: COMEX gold price trend; Source: wind, 36 Krypton overseas stock market's sudden change of face, mainly because the United States in July manufacturing PMI appeared to exceed expectations lower, and thus triggered the risk aversion trade. From the value point of view, the U.S. July ISM manufacturing PMI recorded 46.8, significantly lower than the expected value of 49, and the previous value of 48.5, this data triggered the market to the U.S. economy towards recession concerns, pessimistic views and even that the U.S. economy will be a “hard landing”. Figure: U.S. ISM manufacturing PMI; Source: wind, 36 Krypton excessive panic on asset prices have a negative impact, dismantling the structure of the U.S. manufacturing PMI, July's lower than expected mainly by the new orders, employment, output and other sub-items of the weak due to the structure of the PMI is exactly the same as the U.S. employment data, inflation data to form a cross-corroboration between the data. From the fact that the macro data reflected by the U.S. economy has indeed weakened, and as to whether the recession needs to be further tracked. From the point of view of the above weak sub-item, new orders is not a new low, output and employment is a new low, but these two sub-items are mainly suppressed by the level of interest rates, the economy has cooled is the result of the current monetary policy. As for whether the economy has a “hard landing”, but also depends on the interest rate cuts after these suppressed sectors to repair the situation, if the repair is good, there will not be a so-called “hard landing”, and vice versa. Therefore, the current round of recession trading is mainly dominated by investment sentiment, is not expected to last too long, which is due to the market interest rate cuts have higher expectations; at the same time, more than one dimension of the current economic cooling observed, but also for the Federal Reserve interest rate cuts to create favorable conditions; and, the recession trading led to the market adjustment, in the interest rate cuts expected to make money under the effect instead of the opportunity to enter the field.

Image Source: Sourced from the Internet

Investment strategy: patiently waiting for the recent period of A shares is relatively flat, the short-term rebound is also mainly event-driven, such as the impulse inflow of foreign capital (July 31), regulatory improvements to the trading rules, brokerage restructuring, etc., but these events are relatively unsustainable, then the sustainability of the rebound naturally can not be talked about. From the macro dimension, the current economic recovery is pointing to, the market is at the relative bottom, and then downward adjustment of the space is not much, while upward still need to be further catalyzed. For this year's hot dividend strategy, from the dimension of monetary policy, the future will be dominated by price tools, then under the expectation of domestic interest rate cuts, with the risk-free rate down, the profitability of dividend strategy will have some impact, but in the current market environment, dividends generated by the class of fixed-income income is still a scarce source of stable income under the current market asset shortage. Therefore, in the second half of this year, dividends still have a high allocation value. In terms of segmentation, the dividend attributes of strong banking stocks are currently deposited a large amount of money, with the current market expectations, the banking sector is not easy to see a sharp adjustment, while the elasticity is also relatively limited.

Therefore, it can be appropriate to spread the direction of configuration to high-speed, optional consumption, infrastructure and other sectors. Small and medium-sized venture capital from the relative long-term dimension is relatively weak, but there is no lack of short-term swing opportunities during the period. At present, many investors from the long term optimistic about small and medium-sized trauma in 25 years of primary and secondary linkage brought about by the high boom, and the monetary policy is expected to ease the small and medium-sized trauma is also constituted by the good. Therefore, in the above expectations, the second half of the year may appear in the small and medium-sized creators of the snatch and run market, but the continuity is still doubtful, but you can relax your mind to participate, as a short-term swing market can be.